Do you believe there are patterns in the financial markets that can be taken advantage of?

What if you could see patterns in the financial markets that less than 1 in 1000 day traders were aware of?

I'll never forget the first time I (Richard) lost significant money in trading. It was early 2010 and I bought TLT after it had taken a significant run up. After I bought it, it began to decline almost daily for the next month. When the pain was more than I could bear, I sold it, locking in what for me was a huge loss. To pile on, not long after I sold it, TLT reversed course and began to rise. Why did I buy TLT when I did? It was because of certain things I saw in the charts, and some macroeconomic considerations I had in my mind. I was very wrong.

Our background is physics, and physicists like to understand what's going on underneath the hood when they observe a system evolving. For things like the stock market and bonds, economics seems to be a place to start. But this is often only true in the long run, and as Keynes said, "In the long run, we're all dead".

So to prevent the TLT fiasco from happening again, we decided to answer the question, "Is there a systematic way to profit in the financial markets, using an algorithm, so that the computer tells us when to buy and sell?" At least it would alleviate some of the emotional burden, and maybe even produce profits too.

This is our motivation, remove emotion and discretion from trading, while simultaneously being profitable. The approach we have taken in this quest is a search for patterns. For flexibility and applicability, we wanted to keep our assumptions to a minimum:

- There are simple models which can be used to describe the behavior of financial markets.

- The models have statistical patterns associated with them that can be taken advantage of.

- The patterns may change over time, but there are trading strategies that can adapt to the changes.

Simple Trading Strategies That Work isn't for everyone. Here are 5 reasons why you may decide not to buy this book:

- You don't believe there are patterns in the financial markets that can be used to trade profitably.

- You don't like thinking quantitatively, and you don't know a thing about programming (programming is useful to go beyond the simplest strategies).

- You want to continue to lose money like most other traders.

- You're happy to run with the herd and do what everyone else is doing.

- You think only the big banks can make money trading.

Here is what Perry Kaufman, author of New Trading Systems and Methods has said about a previous version of Simple Trading Strategies That Work:

"One of the basic principles of trading is that certain events cause predictable price reactions. In many cases, related markets react the same way. Stefan and Richard Hollos have written an extremely clear book on how to identify and profit from these moves. Although this falls short of giving us the perfect system, it does give us tools and understanding that every serious trader should have. It will make you look at the markets differently. It's a fast read and I recommend it."

In this 177 page ebook, we reveal:

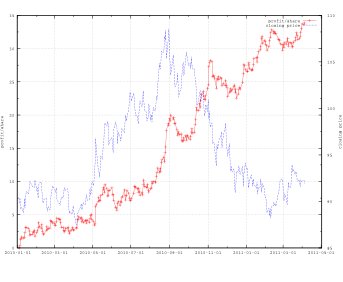

- The simple strategy that led to this profit plot (red is profit, blue is price):

- The two fundamental strategies of trading, one of which is successful every day.

- A positive expectation strategy whose only assumption is that there is a bias (trend). Whether it's up or down doesn't matter.

- Two different ways to model a switching bias (a trend changing direction).

- How to use correlation to improve simple strategies.

- An intuitive explanation of Markov models.

Simple Trading Strategies That Work isn't just theory. We test drive it on 4 ETFs. There are 24 figures and 6 tables, showing the performance of the strategies, and comparing them.

Contrary to other strategies you might have read about, the strategies revealed in this ebook do not require large amounts of historic data, and can be implemented on any time scale.

They say that to solve a difficult problem, sometimes all you need is a change in perspective. This ebook provides a view of financial data you won't find anywhere else, and simple strategies based on this view to get you going in the right direction.

You can get this ebook now at Amazon as a Kindle ebook.

You can also get this ebook instantly as a pdf from Gumroad.

About the authors: Stefan Hollos and J. Richard Hollos are physicists by training, and enjoy finding patterns and information in data. They are the authors of Probability Problems and Solutions, Combinatorics Problems and Solutions, The Coin Toss: Probabilities and Patterns, and Bet Smart: The Kelly System for Gambling and Investing, and are brothers and business partners at Exstrom Laboratories LLC in Longmont, Colorado. The website for their quantitative finance related work is QuantWolf.com. They are interested in anything related to the calculation of probabilities (odds).

Table of Contents

- Disclaimer

- Preface

- Part I Strategies

- Chapter 1 Introduction

- Chapter 2 Binary Random Process

- Chapter 3 BSP and BOP Strategy

- Chapter 4 BSP & BOP Strategy Examples

- Chapter 5 BSP-XY and BOP-XY Strategy

- Chapter 6 BSP-XY & BOP-XY Examples

- Chapter 7 XY Strategy Switching

- Chapter 8 XY Switching Examples

- Chapter 9 Price Markov Model

- Chapter 10 Price Markov Model Examples

- Chapter 11 Price & Volume Markov Model

- Chapter 12 Price & Volume Markov Examples

- Chapter 13 Conclusion

- 13.1 Example Summary

- 13.2 Issues of Period

- Chapter 14 Going Further

- Part II Models

- Chapter 15 Single Coin Model

- 15.1 Random Variables

- 15.2 Betting on the Model

- 15.2.1 Known Bias

- 15.2.2 Unknown Bias

- BSP Strategy

- Majority Rule Strategy

- Chapter 16 2-Coin Model

- 16.1 Betting on a Mean Avoiding Process

- 16.2 Betting on a Mean Reverting Process

- 16.3 General Analysis of the Two Coin Model

- Chapter 17 3-Coin Model

- Appendix A Review of Discrete Probability

- Appendix B Cayley-Hamilton Theorem

Send comments to: Richard Hollos (richard[AT]exstrom DOT com)

Copyright 2011-2014 by Exstrom Laboratories LLC